German Tax ID: What You Need to Know

This page covers the key things you need to know about your German Tax ID (Steuer-ID), an essential number required for setting up and starting work in Germany.

As if starting a new job in Germany was not stressful enough, your employer will also ask for a range of documents in order to start working. Along with a suitable work visa, health insurance, social security number and German bank account, you will also need to provide your employer with your all-important German tax ID.

So, first things first, let us define exactly what a German tax ID is…

What is a German tax ID?

A German tax ID is your personal tax ID in Germany, used by the German authorities to identify you in tax-related matters. No matter the situation, it allows the German tax authorities to accurately assign tax data to the correct individual in Germany.

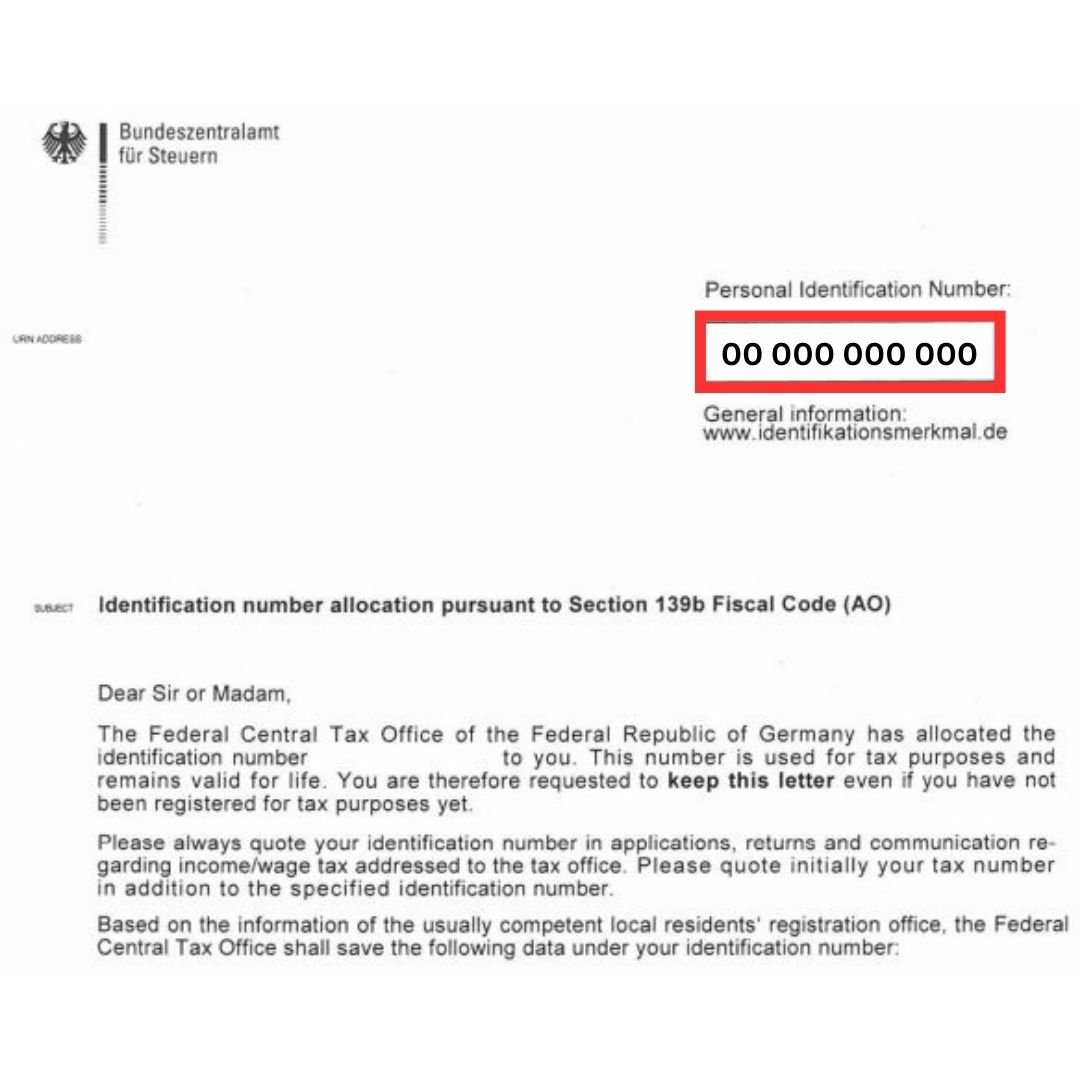

Every individual that is registered at an address in Germany is assigned a unique tax ID number. Your German tax ID remains the same for life, even if you change your name, move address or leave Germany. The tax ID is always 11 digits and written in the following format: 00 000 000 000.

In Germany, they use a bewildering number of names for your German tax ID, but these all refer to the same thing:

Steuer-ID

Steuer-IdNr.

Steueridentifikationsnummer

Steuerliche Identifikationsnummer

Persönliche Identifikationsnummer

IdNr.

TIN

Why is a German tax ID important?

In short, you need a German tax ID in order for your German employer to process your income tax correctly. Your employer just requires your 11-digit tax ID prior to your first payroll.

Failing to provide your German tax ID by your first payroll will mean that you will be assigned to tax class 6, which will result in you being charged the maximum tax rate until you can provide your employer with your tax ID.

In addition, you also need your German tax ID when communicating with your local tax office (Finanzamt), applying for child benefits (Kindergeld), opening a bank account, and various other uses.

With this in mind, it is important to obtain your German tax ID as soon as possible after your arrival in Germany.

How to obtain your German tax ID?

Thankfully, getting hold of your German tax ID is relatively straightforward…

When you complete your address registration (Anmeldung) in Germany for the very first time, your German tax ID is automatically generated by the German Central Tax Office (Bundeszentralamt für Steuern). Your German tax ID is then posted to your registered address, which you can expect to receive within 2–3 weeks of your address registration appointment. The letter containing your German tax ID will look like this:

❗ In order to receive your German tax ID in the post, it is essential that your surname is added to the mailbox at your registered address. Without this, your German tax ID may not be delivered – and the German Central Tax Office may even have you deregistered from the address if it is assumed that you are not living there.

If you are struggling to find accommodation in Germany where you can complete your Anmeldung, see our German Apartment Hunting Guide.

What to do if you lose your German tax ID?

In the event that you lose your German tax ID, you have a few options:

Check your payslips or income tax statement (Lohnsteuerbescheinigung). Your German tax ID will be detailed on these documents.

Request for the German Central Tax Office (Bundeszentralamt für Steuern) to resend your tax ID letter. You can apply for this to be resent here.

Head to your local tax office (Finanzamt) in Germany. A tax office worker will be able to retrieve your tax ID from their system. You can find your local tax office here.

We hope you have found this quick rundown on German tax IDs helpful. For further details on the documents needed to start working in Germany, see our Germany Job Starter Guide.